Real estate taxes in Turkey are an essential aspect of property investment that every foreign buyer and property owner must fully understand. These taxes affect not just the initial purchase but also long-term holding, rental activity, and eventual resale. Turkey’s taxation system includes title deed transfer tax, annual property tax, capital gains tax, VAT (KDV), and income tax on rental earnings. Istanbul Law Firm offers end-to-end legal guidance to ensure foreign clients comply with all Turkish tax obligations while minimizing unnecessary liabilities. Our experienced Turkish Lawyers handle everything from declaration forms to tax office coordination, ensuring that every payment and filing is accurate and timely. Whether you are a private investor, corporate entity, or part of a citizenship-by-investment strategy, we align tax planning with your investment goals. Turkish Law Firm also ensures that property values are declared legally, payment schedules are met, and municipal filings are submitted correctly. With support from our English speaking lawyer in Turkey staff, clients receive fully translated documentation, reminders before deadlines, and representation before tax offices if required. The tax landscape in Turkey changes frequently, and we provide updated legal insight into exemptions, reductions, and penalties. We make sure your real estate investment remains profitable and compliant from day one to exit.

1. Overview of Real Estate Taxation in Turkey

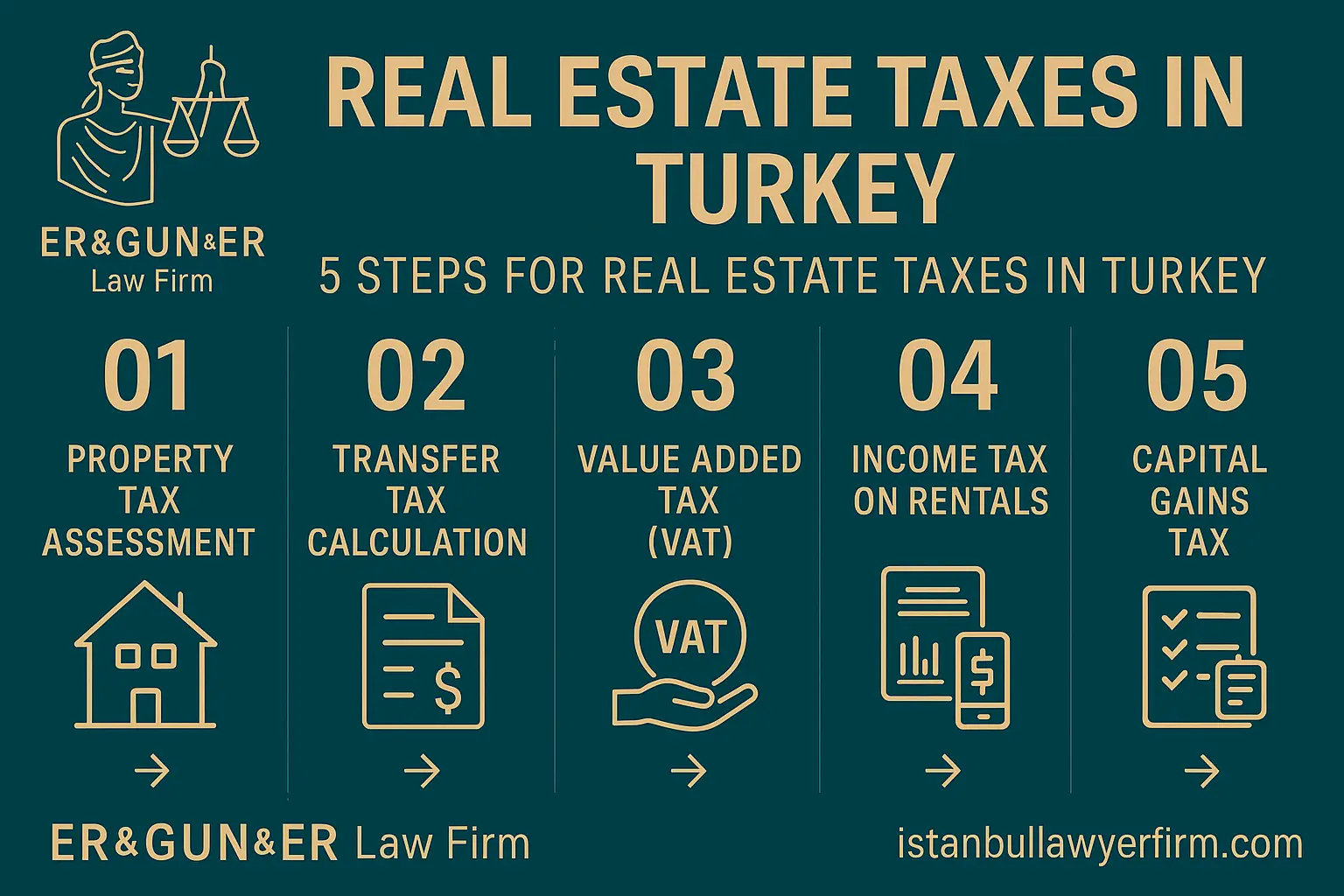

Turkey’s real estate tax framework is governed by several laws, primarily the Real Estate Tax Law (Law No. 1319), the Income Tax Law (Law No. 193), and the Value Added Tax Law (Law No. 3065). Foreign buyers and owners should understand that taxation applies at three distinct stages of property ownership: acquisition, holding, and disposal. At the acquisition stage, you will encounter title deed transfer tax (Tapu Harcı), and in some cases, VAT. During the holding phase, annual property tax and rental income tax (if the property is leased) apply. Upon disposal, capital gains tax may apply depending on the length of time the property was held. Istanbul Law Firm prepares detailed tax planning strategies tailored to each stage. Turkish Lawyers guide clients through determining which taxes apply, how rates are calculated, and how payments are processed. Turkish Law Firm structures the transaction and ongoing ownership so that tax risk is minimized and all reporting obligations are satisfied. English speaking lawyer in Turkey advisors assist in document preparation and help foreign investors stay ahead of audits, late payment fines, or missed declarations. We ensure that taxation never becomes a burden—but a manageable, predictable element of real estate ownership in Turkey.

The Turkish tax system offers both clarity and complexity. While rates are often fixed, application methods vary across municipalities, and exemptions or discounts are sometimes available in certain development zones. Istanbul Law Firm monitors these variations and ensures the correct local interpretations are applied to each client’s case. Turkish Lawyers regularly work with local belediye (municipalities) and vergi dairesi (tax offices) to register properties, verify assessed values, and confirm tax bandings. Turkish Law Firm also manages indexation calculations for inflation-adjusted capital gains and depreciation allowances for rental income. Our legal support ensures that every figure declared to the Turkish Revenue Administration is justified and legally sound. English speaking lawyer in Turkey professionals translate technical documents and represent clients in all official filings. With Istanbul Law Firm overseeing your property tax compliance, you will never be caught off guard by a regulation change or unexpected audit.

Foreign investors should also be aware that certain taxes, like property tax and rental income tax, recur annually. Istanbul Law Firm not only calculates these liabilities but also pays them on your behalf through power of attorney if needed. Turkish Lawyers set reminders for payment deadlines and submit all declarations digitally through the e-Devlet platform. Turkish Law Firm provides a legal summary at the end of each year outlining paid taxes, upcoming obligations, and possible optimizations. English speaking lawyer in Turkey staff explain these summaries in clear, non-technical language. We help clients take advantage of tax deductions, comply with rental income thresholds, and avoid double taxation where treaties apply. In every aspect of ownership, from the first tax filing to exit strategy planning, we ensure you pay what’s legally owed—and not a lira more.

2. Title Deed Transfer Tax (Tapu Harcı)

Tapu Harcı, or the title deed transfer tax, is a one-time tax levied at the point of acquisition. It is calculated at 4% of the declared sale value and is paid at the Land Registry Office during the title deed transfer appointment. While the law stipulates that this tax be shared equally between buyer and seller, in practice, it is often borne entirely by the buyer. Istanbul Law Firm helps clients structure contracts that clearly specify Tapu Harcı responsibilities, avoiding misunderstandings or future disputes. Turkish Lawyers ensure that the declared value meets or exceeds the municipality-assessed threshold (rayiç bedel) to avoid penalties. Turkish Law Firm files the declaration, submits payment at the registry, and provides the client with official receipts. English speaking lawyer in Turkey staff guide international clients through every step, including valuation report review and price disclosure protocols. We make sure that your Tapu Harcı is legally sound and contractually protected.

Certain projects or urban zones may qualify for a Tapu Harcı reduction—sometimes down to 3%. Istanbul Law Firm checks whether your property falls within a qualifying category and applies any discounts accordingly. Turkish Lawyers coordinate with developers, municipalities, and the Revenue Administration to confirm eligibility. Turkish Law Firm also monitors whether incentives are temporary or tied to the Turkish Citizenship by Investment program. Our legal support includes explaining timing strategies that can lower this cost without compromising the deal. English speaking lawyer in Turkey personnel remain in close contact with the Land Registry to avoid errors in payment or declaration. With our guidance, this essential tax is not just paid—it’s optimized.

We also provide long-term advice on how Tapu Harcı affects future sale value reporting and capital gains liability. Istanbul Law Firm keeps a record of declared values for use in resale declarations, audit defense, or inheritance filings. Turkish Lawyers handle reassessment petitions when municipalities increase base values unfairly. Turkish Law Firm files legal objections and evidence packets where clients are overcharged. English speaking lawyer in Turkey advisors ensure clients understand the Tapu process, the financial breakdown, and the legal implications of under- or over-declaration. From negotiation to execution, we protect both your ownership and your compliance with Turkish tax law.

3. Annual Property Tax (Emlak Vergisi)

Annual property tax, known as Emlak Vergisi in Turkish, is one of the most fundamental ongoing obligations for all real estate owners in Turkey, including foreign nationals. This tax is assessed and collected by the local municipality (belediye) where the property is located and is payable in two equal installments, typically in May and November. Istanbul Law Firm ensures that foreign buyers are aware of this annual tax from the outset and that it is budgeted into the cost of long-term ownership. Turkish Lawyers calculate this tax based on the rayiç bedel—the official assessed value registered with the municipality—and confirm that the rate is accurate. Turkish Law Firm submits the declaration form, verifies the calculated amount, and arranges electronic or in-person payment. English speaking lawyer in Turkey advisors explain all procedures in the client’s native language and provide annual reminders. Failure to pay on time results in penalties and interest, which can accumulate over the years and complicate future resale or inheritance. Our legal team prevents this with advance planning and digital tracking tools. We treat this seemingly simple tax with the seriousness it deserves, because proper compliance protects your title deed status and financial standing.

Rates for annual property tax vary depending on whether the property is residential, commercial, or land, and whether it is located in a metropolitan or non-metropolitan municipality. For residential properties in major cities like Istanbul, Ankara, and Izmir, the standard rate is 0.2% of the assessed value, while commercial properties are taxed at 0.4%. Istanbul Law Firm helps clients identify the correct classification and apply for reductions if the property is used as a primary residence or belongs to retirees. Turkish Lawyers also assist in challenging inflated assessments and requesting reevaluations if the municipal rate is incorrect. Turkish Law Firm provides property tax appeal services and represents clients before the municipal board if disputes arise. English speaking lawyer in Turkey staff keep track of tax rate changes announced by the Ministry of Environment, Urbanization, and Climate Change. We combine legal expertise with local municipal insight to ensure that you only pay what is legally required—nothing more.

Our firm also supports owners of multiple properties or portfolios spread across cities. Istanbul Law Firm maintains an annual tax matrix for each client, listing due dates, amounts, and payment channels. Turkish Lawyers use power of attorney to submit all payments and declarations on time. Turkish Law Firm delivers end-of-year summaries for tax records and citizenship filing support where applicable. English speaking lawyer in Turkey professionals explain deductions, exemptions, and cumulative totals. In case of property sales or changes in ownership, we assist in filing tax adjustments and obtaining clearance certificates to confirm that no back taxes are owed. Properly managing annual Emlak Vergisi obligations helps preserve property value and facilitates smooth transactions. With Istanbul Law Firm managing your tax calendar, property ownership becomes stress-free and financially predictable.

4. Rental Income Tax for Property Owners

Foreign property owners in Turkey who lease out their properties are subject to rental income tax, which must be declared annually to the Turkish Revenue Administration (Gelir İdaresi Başkanlığı). Istanbul Law Firm assists landlords in understanding their obligations and filing accurate rental declarations. Turkish Lawyers first confirm whether the rental qualifies as residential or commercial and determine the applicable tax bracket. Turkish Law Firm applies allowable deductions, such as property maintenance costs, depreciation, and management fees, to reduce taxable income. English speaking lawyer in Turkey advisors prepare the necessary documents in coordination with certified accountants and submit the declaration electronically. The declaration must be filed in March of the following year, covering rental income earned between January 1 and December 31. Penalties for non-declaration include fines, interest, and possible criminal proceedings in case of willful evasion. We ensure full compliance and secure client peace of mind.

Turkey offers a standard deduction system (götürü gider) where 15% of gross income is automatically deducted, or an actual expenses method (gerçek gider) where documented expenses are itemized. Istanbul Law Firm advises clients on which model to choose based on their financial profile. Turkish Lawyers also ensure that any lease contracts are notarized, registered with the local tax office, and comply with landlord-tenant laws. Turkish Law Firm files declarations for both individual and corporate property owners and liaises with the tax office in case of questions or audit requests. English speaking lawyer in Turkey advisors explain every line item on the form and provide copies for the client’s records. We also update clients if new exemptions, rate changes, or indexation rules are introduced. Managing rental income tax is not just about reporting earnings—it’s about preserving compliance and future legal flexibility.

We also assist clients with short-term rental taxation, especially for platforms like Airbnb. Istanbul Law Firm ensures compliance with tourism license requirements and municipal regulations. Turkish Lawyers calculate tax liability for daily rentals and file VAT declarations if required. Turkish Law Firm also coordinates with professional accountants to track booking revenues, commission costs, and online platform deductions. English speaking lawyer in Turkey staff assist with online tax portal access and technical support. By managing your rental income tax obligations from A to Z, we protect your legal status, reduce audit risk, and keep your investment safe and profitable. Whether you're leasing long-term or short-term, our legal tax support ensures full regulatory alignment.

5. Capital Gains Tax on Property Resale

Capital gains tax applies to property owners who sell their Turkish property within five years of acquiring it. The tax is calculated on the difference between the declared purchase price and the declared sale price, adjusted for inflation and allowable deductions. Istanbul Law Firm advises sellers on how to structure sales to either minimize or completely avoid this tax legally. Turkish Lawyers calculate the exact holding period, apply indexation rules issued by the Revenue Administration, and file the correct capital gains tax declaration. Turkish Law Firm also checks whether the property qualifies for exemptions, such as those held longer than five years or family transfers. English speaking lawyer in Turkey advisors prepare the declaration, issue receipts, and assist in payment coordination. The tax is filed annually in March of the year following the sale and must be paid in two equal installments. Avoiding or underreporting this tax can result in significant penalties, making legal guidance essential.

We also assist in calculating the tax impact of foreign currency gains or losses, especially when the purchase and sale transactions occur in different currencies. Istanbul Law Firm ensures that these variations are reported accurately and supported by bank statements, valuation reports, and sale contracts. Turkish Lawyers structure payment receipts to reflect legal and financial clarity. Turkish Law Firm also represents clients during tax audits, inquiries, or disputes with the Revenue Administration. English speaking lawyer in Turkey professionals help clients understand why the tax applies, how it's calculated, and how to manage it responsibly. With our help, capital gains tax becomes a routine part of a profitable exit—not a surprise penalty at the end of an otherwise successful transaction.

Our legal team also advises clients planning to reinvest sales proceeds in new Turkish properties or citizenship applications. Istanbul Law Firm helps structure sales to align with future investment goals and ensures that tax timing and documentation support these plans. Turkish Lawyers prepare transition strategies to limit or defer tax liability when appropriate. Turkish Law Firm keeps all transaction data archived for five years in compliance with Turkish recordkeeping laws. English speaking lawyer in Turkey staff are available year-round for post-sale tax queries. With our end-to-end support, property resale becomes a financially and legally streamlined process. Whether you are selling one property or many, our team helps protect your profits—and your legal standing.

6. VAT (Value Added Tax) in Real Estate Transactions

Value Added Tax (KDV in Turkish) may apply to certain real estate transactions in Turkey, depending on the nature of the seller, the type of property, and the buyer’s status. While many residential property sales between individuals are VAT-exempt, transactions involving developers or commercial entities often include VAT charges ranging from 1% to 18%. Istanbul Law Firm analyzes the VAT liability of each transaction at the beginning of the legal review to prevent unexpected costs. Turkish Lawyers assess whether the property qualifies for exemption or reduced VAT rates, based on its size, location, usage classification, and whether it’s the buyer’s first property. Turkish Law Firm also reviews developer tax registration, invoice issuance practices, and compliance with Ministry of Finance regulations. English speaking lawyer in Turkey advisors explain how VAT affects the total price, payment plan, and timing of legal documentation. This tax is often not included in property advertisements and surprises many foreign buyers during contract execution. With our legal foresight, clients know exactly when VAT applies—and how to structure the deal accordingly.

In some cases, foreign buyers may benefit from a VAT exemption when purchasing newly constructed properties for residential use, provided certain criteria are met. Istanbul Law Firm helps clients navigate the requirements for this exemption, which include not having Turkish residency and transferring funds from abroad. Turkish Lawyers prepare the exemption application and submit it to the local tax office with all supporting documentation, including bank receipts and residency declarations. Turkish Law Firm also ensures that the title deed and sales invoice reflect VAT exemption correctly, so the buyer is not liable retroactively. English speaking lawyer in Turkey professionals remain in contact with both the developer and tax authorities until exemption confirmation is issued. If not structured properly, buyers may be forced to pay full VAT during the deed transfer—a cost that could have been avoided. We provide end-to-end legal protection so clients never miss out on this powerful incentive. VAT exemption, when properly applied, can save buyers thousands of euros and make a significant difference in total investment return.

Our firm also advises developers and sellers on their own VAT liabilities and reporting responsibilities. Istanbul Law Firm structures sale agreements to reflect accurate pricing, inclusive or exclusive of VAT, and assists in issuing legally compliant invoices. Turkish Lawyers advise on VAT deferral strategies, installment recognition, and reconciliation with the Revenue Administration. Turkish Law Firm represents clients during VAT audits and prepares response documentation for regulatory queries. English speaking lawyer in Turkey teams track recent VAT legislation, especially concerning tourism-zoned properties, serviced apartments, and commercial units with dual licenses. Our legal support ensures that all parties understand and fulfill their VAT obligations without risking tax penalties or deal cancellations. From exemption planning to post-sale compliance, we make VAT a manageable part of your real estate transaction in Turkey.

7. Municipal Fees and Environmental Taxes

Aside from nationally imposed real estate taxes, property owners in Turkey are also subject to local municipal fees and environmental levies. These fees are often small individually, but can accumulate over time and may become enforceable debts against the property. Istanbul Law Firm helps foreign owners understand their municipal obligations and ensure timely compliance. Turkish Lawyers register your property with the local belediye and verify whether garbage collection, lighting, and infrastructure contribution fees apply. Turkish Law Firm also monitors changes in local fee structures and updates clients annually. English speaking lawyer in Turkey advisors explain each fee line item and coordinate online or in-person payment. Many of these charges are tied to property use, size, and location, and may differ substantially from one district to another. For clients owning more than one property, we maintain a local tax calendar to ensure all payments are made without delay. These municipal charges, while often overlooked, are an essential part of full compliance and long-term property stewardship in Turkey.

Environmental taxes are levied by municipalities to fund water sanitation, solid waste management, and local environmental improvement projects. These taxes apply to both residential and commercial properties, and are generally billed together with water service invoices. Istanbul Law Firm ensures that environmental tax rates are applied correctly and not inflated due to billing errors or misclassified property status. Turkish Lawyers also assist in updating occupancy records with the municipality when ownership or usage changes. Turkish Law Firm checks that all past dues are cleared during resale or inheritance transactions. English speaking lawyer in Turkey teams request closing statements from municipal finance departments and archive them for future title deed transfers. With our legal oversight, clients never inherit unknown debts or face service suspensions due to administrative oversights. Environmental taxes, when managed properly, are a small but important part of legal property ownership in Turkey.

We also support owners of short-term rental properties, who often face stricter municipal scrutiny. Istanbul Law Firm ensures that short-term rental permits, tourism tax declarations, and enhanced environmental fees are handled legally. Turkish Lawyers file required forms and submit annual declarations with the local tourism and finance offices. Turkish Law Firm also manages disputes arising from unregistered tenants, neighbor complaints, or building regulation violations. English speaking lawyer in Turkey staff help clients navigate these procedures without language barriers or legal confusion. Our aim is to ensure that even the most locally applied taxes are not a surprise but a well-documented, predictable obligation. With our guidance, clients maintain excellent standing with both national and local authorities—protecting property value and legal reputation alike.

8. Inheritance and Gift Tax for Real Estate in Turkey

Foreigners who inherit or receive real estate in Turkey as a gift are subject to the Turkish Inheritance and Gift Tax Law. This tax applies to transfers of property upon death or donation, and is calculated based on the property’s assessed value and relationship between the parties. Istanbul Law Firm helps heirs and donors understand how this tax works and how to minimize their liabilities within the law. Turkish Lawyers determine the applicable rate, which ranges from 1% to 30% depending on the property value and relationship category. Turkish Law Firm submits the declaration form within four months for domestic transfers and within six months for international transfers. English speaking lawyer in Turkey staff coordinate notarized documentation, inheritance registry filings, and succession court approvals. We ensure that inheritance is transferred legally, recorded with the title registry, and taxed correctly—without delay or penalty.

In many cases, heirs are unaware of their obligation to declare inherited property, particularly if the deceased was a foreign national. Istanbul Law Firm ensures full legal integration by checking both Turkish and foreign registry systems. Turkish Lawyers file court petitions if necessary to formalize inheritance shares and resolve disputes among beneficiaries. Turkish Law Firm also coordinates foreign death certificate legalization, will translation, and notarized beneficiary declarations. English speaking lawyer in Turkey advisors walk clients through step-by-step and manage document collection across jurisdictions. We’ve assisted dozens of families worldwide in safely inheriting Turkish property without needing to travel. Proper tax planning ensures heirs do not overpay or lose property due to missed declarations. Inheritance, when managed correctly, is a seamless legal process that secures family wealth across generations.

Our firm also helps donors structure gifts of real estate to minimize tax exposure and avoid later disputes. Istanbul Law Firm drafts donation contracts, manages registration with the Tapu Office, and calculates gift tax precisely. Turkish Lawyers explain whether the gift qualifies for spousal or child exemptions and structure payments accordingly. Turkish Law Firm keeps a record of each gift’s value and legal classification for future audit defense. English speaking lawyer in Turkey teams assist clients in understanding how lifetime gifts affect estate planning, Turkish inheritance law, and citizenship filings. With our strategic support, clients can make meaningful property transfers while preserving their legal and financial positions. We protect your legacy—and your loved ones’ peace of mind.

9. Double Taxation Treaties and International Compliance

For foreign property owners in Turkey, international tax compliance is just as important as local compliance. Fortunately, Turkey has signed double taxation treaties with over 80 countries to prevent individuals from being taxed twice on the same income. Istanbul Law Firm reviews your country of residence and determines whether a tax treaty exists and how it applies to your rental income, capital gains, or inheritance. Turkish Lawyers interpret treaty provisions, including tax credit allowances, exemption clauses, and definitions of tax residency. Turkish Law Firm prepares compliance strategies that integrate both Turkish and international obligations. English speaking lawyer in Turkey advisors coordinate with international tax consultants to ensure your tax reporting is accurate and treaty-compliant. We help you avoid penalties, minimize tax overlap, and stay fully transparent in both jurisdictions.

Double taxation treaties are especially important for rental income. In many cases, Turkey has the first right to tax property-derived income, but your home country may require you to report the income and either tax it or apply a credit. Istanbul Law Firm helps you prepare rental income reports that align with foreign tax return requirements. Turkish Lawyers also advise on the classification of income (passive vs active), currency conversion standards, and allowable deductions under both systems. Turkish Law Firm provides summary statements that can be submitted abroad as part of your annual tax return. English speaking lawyer in Turkey professionals also explain your FATCA and CRS obligations if you're a U.S. citizen or a resident of an OECD country. We manage the entire legal framework so that you can enjoy your Turkish property without triggering audit risks or unexpected tax assessments abroad.

We also support clients in navigating tax residency rules. Istanbul Law Firm advises clients on whether their time spent in Turkey could result in Turkish tax residency, which may expand their tax obligations. Turkish Lawyers help calculate the 183-day threshold, structure property use accordingly, and prepare residency status declarations. Turkish Law Firm keeps your property tax-compliant while avoiding unnecessary personal tax complications. English speaking lawyer in Turkey staff support exit filings and foreign tax disclosures. With our guidance, your tax exposure remains predictable, documented, and fully compliant both in Turkey and globally.

10. Why Work with Istanbul Law Firm for Real Estate Taxation

Working with Istanbul Law Firm for real estate tax planning ensures that your investment remains profitable, legally secure, and tax-efficient. We go beyond basic compliance to create proactive, customized tax strategies for each client. Turkish Lawyers analyze every transaction detail—from acquisition to holding to exit—and develop tailored solutions that save money and reduce legal risk. Turkish Law Firm handles annual tax filings, rental income declarations, Tapu Harcı payments, VAT filings, and inheritance documentation. English speaking lawyer in Turkey professionals translate and deliver every tax document in a format clients understand. Whether you're buying a single property or managing a real estate portfolio, our legal team ensures your tax compliance is complete and worry-free.

We also provide integrated support. Istanbul Law Firm works with accountants, tax consultants, and investment managers in your home country to ensure international compliance. Turkish Lawyers issue legal memos, respond to audits, and act as your local tax representative in Turkey. Turkish Law Firm creates an annual tax calendar personalized for each client and tracks all obligations automatically. English speaking lawyer in Turkey staff provide alerts, updates, and document submissions throughout the year. With our support, you never miss a deadline, pay more than necessary, or risk a regulatory penalty. We offer full visibility and total confidence in your real estate tax management.

Ultimately, our goal is to protect your real estate investment from legal and financial risk while maximizing its long-term return. Istanbul Law Firm is not just your tax advisor—we are your legal partner in every aspect of property ownership. Turkish Lawyers advocate for your interests, correct under-declarations, and defend your rights at every stage. Turkish Law Firm helps you plan, pay, and profit—without stress or surprises. English speaking lawyer in Turkey teams are always ready to answer questions, explain changes, and assist in every compliance matter. Work with us to keep your real estate taxes under control and your legal standing perfectly intact.

Frequently Asked Questions (FAQ)

- What taxes do I pay when buying property in Turkey? – You pay Tapu Harcı (title deed tax), usually 4% of the declared value.

- Is annual property tax mandatory for foreigners? – Yes, all owners pay annual property tax, regardless of nationality.

- Do I pay tax on rental income in Turkey? – Yes, rental income must be declared and is taxed progressively.

- Can I benefit from VAT exemption? – In some cases, yes. We assess eligibility based on property type and purchase conditions.

- How is capital gains tax calculated? – Based on the price difference between sale and purchase, adjusted for inflation.

- What if I don’t pay my property taxes? – You face penalties, interest, and legal enforcement through municipal liens.

- Is there inheritance tax in Turkey? – Yes. Rates vary based on the value and relationship of the inheritor.

- Can I deduct expenses from rental income? – Yes, under the real expenses method or the standard deduction system.

- What is Tapu Harcı and when is it paid? – It is the title deed registration tax, paid at the time of property transfer.

- Can Istanbul Law Firm handle tax filings for me? – Yes. We manage full tax compliance on your behalf through POA.

- Does Turkey have tax treaties with other countries? – Yes. We apply treaty rules to avoid double taxation.

- Why choose Istanbul Law Firm? – We offer strategic, full-service legal support for every tax issue in Turkish real estate.

Get Full Legal Support for Real Estate Taxation in Turkey

Istanbul Law Firm is your legal partner for every tax matter in Turkish property. With our experienced Turkish Lawyers and responsive English speaking lawyer in Turkey advisors, your investment stays legally secure and financially smart.