Filing a tax objection in Turkey can be complex, especially for foreigners unfamiliar with local taxation systems and administrative procedures. It requires understanding deadlines, documentation requirements, and communication channels with tax authorities. A well-structured legal objection can prevent unnecessary penalties and financial burdens. This guide provides a step-by-step overview to help you prepare, submit, and follow up on your objection efficiently. Working with experienced legal counsel ensures that all procedural rules are respected and written arguments meet formal standards. For foreign taxpayers, this structured support reduces stress and increases chances of successful objection. Engaging legal assistance early avoids missing key steps or deadlines due to language or bureaucratic hurdles. Clarity in process leads to stronger legal protection and financial certainty.

1. Understanding the Tax Objection Procedure

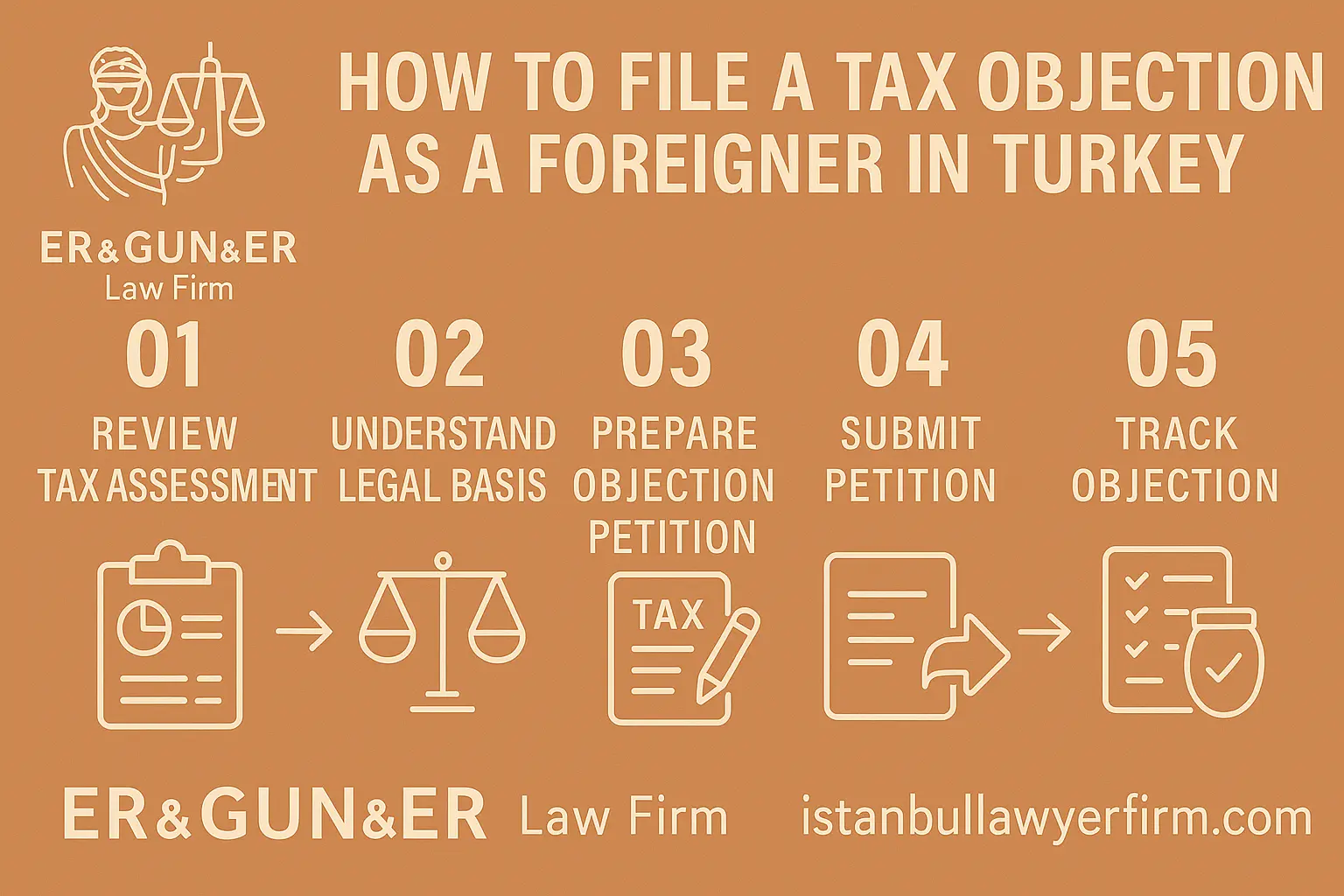

The first step in any tax objection Turkey case is identifying the assessment you plan to dispute—whether it's an income tax assessment, VAT fine, or audit penalty. Our law firm in Istanbul assists in analyzing the tax notice, validating calculation methods, and identifying legal bases for objection. We explain detailed rules from the Turkish tax procedure law that define objection deadlines, statutory forms, and submission protocols. As a trusted lawyer in Turkey, we prepare your formal objection letter, ensure proper format, and collect supporting documents. An English speaking lawyer in Turkey also prepares translations and bilingual versions for authorities and foreign clients to review. Timely submission is critical—missing the standard 30-day deadline may block your rights permanently. Early legal intervention ensures all procedural obligations are observed and your case proceeds correctly.

Once submitted, the objection is reviewed by the tax office, which may accept, partially adjust, or reject it. If the objection is not resolved favorably, the next step could be filing in tax court Turkey. Our Turkish lawyers evaluate whether to escalate the matter based on financial thresholds or legal merit. As best lawyer in Turkey graded experts, we design objection strategies to strengthen your position in court or administrative review. With precise documentation and legal arguments, we target maximum possible relief from penalties and interest. For foreign clients, all procedural guidelines are clarified with both Turkish and English correspondence to ensure full understanding. Navigating this stage correctly often determines the ultimate outcome of your tax dispute.

2. Assembling Your Objection File and Annexes

Effective objection requires a well-documented case file, matching each contested point with evidence and legal arguments. Our Istanbul Law Firm structures your documentation to address each item in the tax notice—whether it concerns income tax assessment, tax penalty appeal Turkey issues, or audit deficiencies. We gather financial records, invoices, contracts, and audit responses to support your claims. An English speaking lawyer in Turkey ensures translations are accurate and notarized where required, especially for foreign-sourced documents. This professional approach reduces delays and supports a compelling legal position. As lawyer in Turkey, we also validate consistency across documents and tax forms filed to prevent contradictions. A complete and coherent file earns greater credibility with tax authorities and enhances your chance of success. Crafting these annexes accurately minimizes follow-up queries and strengthens the objection process from start to finish.

In parallel, we prepare sworn declarations, affidavits, and statutory forms required under Turkish tax procedure law. This includes detailed timelines, referenced legal articles, and summarized case law supporting your position. Our law firm in Istanbul ensures all forms are signed, stamped, and submitted in compliance with official registry. We track the objection timeline—filing date, issue dates, hearings, and deadlines—to maintain legal visibility. As part of our service, we also prepare a summary memo in English for foreign clients highlighting key objection points. This legal package removes ambiguity and maximizes clarity as your case moves forward.

3. Identifying Legal Grounds for Objection and Dispute Resolution

An objection isn’t accepted by default; you must articulate valid arguments under Turkish tax procedure law and tax dispute resolution Turkey mechanisms. Our law firm in Istanbul analyzes the tax notice to pinpoint calculation errors, misapplication of exemptions, or interest miscalculations. We reference precedents to support your case, comparing similar decisions by appeal boards or tax courts. An English speaking lawyer in Turkey clarifies each argument in both languages, ensuring your foreign documentation is understood. As an expert lawyer in Turkey, we advise on whether the matter should stay administrative or escalate to litigation. Proper legal strategy significantly boosts your appeal success rate. Taking the correct dispute resolution Turkey path at the right time prevents unnecessary costs.

If the objection is disputed, we can pursue mediation or passa through administrative appeal boards first. Our Turkish lawyers represent clients in such panels, emphasizing factual evidence and legal provisions. We prepare oral presentations and written summaries to ensure the objection remains within regulatory scope. For cases that exceed financial or legal complexity thresholds, we prepare for tax court Turkey representation. Clear preparation, timely filing, and structured argumentation are crucial. This process helps to avoid protracted litigation and ensures tax authorities reconsider assessments. We stay with you through every dispute resolution step.

In contested cases, professional dispute support can prevent escalating to full court litigation. As the best lawyer in Turkey in this domain, our firm manages the balance of cost and benefit for each objection. We prepare risk assessments, anticipate counterarguments, and model potential outcomes. An lawyer in Turkey supervises communication with tax authorities to avoid misinterpretation. We coordinate document revisions and follow-up hearings to keep you informed. Expert support ensures missteps are corrected early and your objection retains strength throughout. This reduces financial exposure and procedural fatigue for foreign taxpayers.

4. Common Reasons for Filing a Tax Objection

Foreign taxpayers often encounter errors in income tax assessment Turkey from unfair valuation of earnings, incorrect withholding tax, or misreported deductions. Our tax objection Turkey service addresses these issues by carefully verifying past returns, bank records, and tax forms. We spot miscalculations in VAT, SCT, or stamp duty that often affect foreign investment or expatriate payments. As an experienced law firm in Istanbul, we submit amendment requests based on discovered discrepancies. An English speaking lawyer in Turkey ensures explanations are accurate, detailed, and contextually clear. This proactive cleanup can eliminate unnecessary liabilities or interest charges.

Additional grounds include procedural errors like missing notifications or incorrect office handling. Our Turkish lawyers check whether the tax office followed official notification timelines, which could nullify the assessment. We also flag calculation errors in tax penalty appeal Turkey formal letters. As best lawyer in Turkey, we prepare to argue procedural invalidity or lack of authority. This ensures your objection is legally sound and strategically positioned for success. Clarity on official compliance significantly enhances your objection’s impact.

Finally, audit-related objections—such as those needing tax audit defense Turkey—are common. Our firm gathers necessary backup documents, audit records, and transfer pricing files if needed. We challenge over-audited entries or scope violations by the tax office. As an experienced lawyer in Turkey, we also explore settlement possibilities where litigation costs exceed benefits. This can lead to more efficient resolutions with better financial outcomes. Our strategy always aligns with your best interests and long-term financial planning.

5. Navigating Timing, Fees, and Legal Costs

Every objection must be filed within the 30-day deadline after the notification date, or your rights will be irrevocably lost. Our law firm in Istanbul sends reminders and calculates timelines to ensure timely filing. We also clarify fee requirements, such as stamp duty or provisional deposits needed to process your objection. As a recognized lawyer in Turkey, we provide transparent fee estimates and cost-benefit analysis. An English speaking lawyer in Turkey explains fee structures in your currency to avoid confusion. This transparency helps you plan financial commitment accurately.

Legal costs may include filings, administration fees, translation, and representation—noting that complex cases may require court filings. Our Turkish lawyers draft detailed cost breakdowns and payment schedules, removing unexpected billing. As a best lawyer in Turkey, we manage court steps if escalation occurs, including representing you in the tax court Turkey system. We also offer package services for frequent foreign investors to standardize cost management. This predictability reduces financial anxiety and allows better planning during disputes.

With timely payment of required fees and support from legal counsel, you can avoid unnecessary delays and penalties. Our firm offers flexible fee structures—including fixed-fee objections and hourly litigation rates. An lawyer in Turkey ensures that each stage’s costs are approved before proceeding. This avoids surprises at every layer of administrative or judicial dispute resolution. Clear budgeting supports informed decision-making and sustained legal engagement until final resolution.

6. Representing You in Tax Court and Higher Appeals

If you decide to escalate beyond administrative appeal, representation before tax court Turkey becomes necessary. Our law firm in Istanbul prepares court petitions, evidence compilations, and legal arguments framed under Turkish tax procedure law. We analyze case law precedent and draft concise memoranda to support your position. As dedicated lawyer in Turkey, we ensure hearings are attended, statements recorded, and timelines monitored. Our English speaking lawyer in Turkey communicates progress, next steps, and possible outcomes clearly. Being present at court hearings strengthens your case credibility. We also manage appeals to higher regional courts when necessary to secure best possible outcome.

We support both expedited and standard litigation tracks depending on case urgency. Our Turkish lawyers assess whether administrative appeals or full court hearings have higher potential for success. We prepare risk and cost projections so you can make informed decisions aligned with your financial strategy. As the best lawyer in Turkey for foreign taxation, we optimize legal strategy for consistency and efficiency. Court representation includes coordinating expert testimony when necessary. Decisions from the court often carry weight in future objections or audits.

Even during litigation, we monitor procedural compliance, court notifications, and enforcement risks. Our lawyer in Turkey provides ongoing updates on case status, hearing outcomes, and next steps. We also analyze adverse judgments to determine whether higher appeal or settlement is preferable. Our court presence aims to minimize disruptions to your business activities. With experienced representation, you avoid common pitfalls that foreign taxpayers may face in Turkish tax litigation. This ensures thorough advocacy and best-case procedural support until final decision.

7. Tax Penalty Appeals and Resolution Methods

Tax penalties may arise due to late filings, underpayment of taxes, or audit findings, and a structured tax penalty appeal Turkey is required to challenge them. Our law firm in Istanbul reviews the legality of each penalty, whether it concerns VAT, withholding tax, or tax audit defense Turkey issues. We prepare detailed appeals including legal references and evidence to justify penalty removal or reduction. As your lawyer in Turkey, we file appeals within strict deadlines, ensuring no rights are forfeited. An English speaking lawyer in Turkey also composes appeal drafts in both Turkish and English to maintain clarity. This avoids misinterpretation by authorities and speeds resolution.

We advise on negotiation options, reduced penalty settlements, or installment agreements with the tax authority. Our Turkish lawyers handle communication with tax offices to propose practical solutions. As the best lawyer in Turkey, we strategize whether litigation or administrative objection offers better outcomes financially. Where available, we advise on alternative dispute resolution methods. Our legal advocacy helps you maintain compliance without jeopardizing liquidity. Early intervention often leads to more favorable penalty reduction agreements.

All actions are tied to the greater goal of tax dispute resolution Turkey and maintaining clean taxpayer records. Our approach includes monitoring agreements, managing payment plans, and ensuring finalized resolution is legally documented. A persistent lawyer in Turkey ensures closure and prevents future enforcement notices. Post-resolution, we audit your compliance systems to avoid repeat penalties. This proactive closing strategy minimizes future risk and restores tax profile integrity.

8. Protecting Foreigner Tax Rights and Preventing Future Disputes

Foreign nationals often encounter unique tax challenges, including foreigner tax rights Turkey and misapplication of withholding or reporting obligations. Our law firm in Istanbul educates clients on their rights under bilateral treaties and domestic law. We review previous filings and audit history to identify irregularities. As an expert lawyer in Turkey, we prepare protective legal statements and request formal clarifications from tax offices. An English speaking lawyer in Turkey ensures all communications accurately reflect foreign ownership structures and income sources.

Proactive compliance remains essential to avoid recurring disputes, especially after a successful objection. Our Turkish lawyers help set up tax compliance calendars, notification reminders, and documentary checklists. We align your accounting and banking systems with Turkish tax procedure law. The best lawyer in Turkey can also negotiate advance tax rulings to gain certainty on taxable events. This builds legal certainty for cross-border income and minimizes future objection needs.

We also provide training to your team or financial advisors on maintaining foreign investment compliance in Turkey. Our lawyer in Turkey offers workshops on international taxation and audit readiness. We can draft standardized policy documents to support internal control and prevent misreporting. These safeguards protect your tax status and reputation in Turkey. Effective legal and operational compliance builds confidence and streamlines future transactions.

9. Preventing Future Tax Disputes Through Legal Audit and Planning

After resolving a tax objection, preventing future tax disputes should become a top priority. Our Turkish Law Firm offers ongoing compliance audits to monitor procedural adherence, filing accuracy, and documentation completeness. We examine potential triggers that may cause future disputes such as mismatched declarations or inconsistent filings. A skilled lawyer in Turkey develops tailored audit protocols and recommends policy changes. We also offer checklists and templates for regular compliance reviews. Our English speaking lawyer in Turkey ensures all updates are communicated clearly to international clients. By analyzing past disputes, we help strengthen your overall tax structure. Legal oversight and audit planning support sustainable tax integrity in Turkey.

We also conduct internal legal training for accounting teams, controllers, or external bookkeepers. Our tax audit defense Turkey model includes practical guidance on documentation, audit response letters, and pre-assessment notice handling. By preparing clients proactively, we eliminate panic during future tax reviews. Our Turkish lawyers also help implement tax governance policies, escalation workflows, and audit timelines. As your strategic legal partner, we monitor regulatory updates and communicate change management strategies. With ongoing planning, tax disputes become the exception, not the norm.

For foreign investors and corporate taxpayers, our firm provides quarterly legal compliance reviews, case law updates, and early warning diagnostics. The best lawyer in Turkey ensures policy alignment with evolving Turkish tax procedure law. We align our prevention strategy with your risk profile and investment plans. This foresight minimizes legal surprises and preserves financial predictability. Preventive legal structuring strengthens both credibility and profitability for long-term taxpayers in Turkey.

10. Strategic Residency and Financial Planning for Long-Term Investors

Tax objections often coincide with broader issues such as residency status, business structure, and banking compliance. Our law firm in Istanbul supports long-term investors by combining tax advice with residence planning. We guide clients through income tax assessment Turkey strategies that optimize residence permits and global income declarations. A focused lawyer in Turkey maps residency plans to financial reporting and investment structuring. We assist in realigning permits, investment vehicles, and asset location to achieve full legal consistency. With holistic planning, foreign clients can live, invest, and work in Turkey without fiscal conflict.

We also coordinate with immigration lawyers to confirm your tax and immigration strategies remain synchronized. A senior English speaking lawyer in Turkey integrates immigration law with fiscal forecasting for high-net-worth clients. We manage tax rulings, advance clearance requests, and treaty assessments. Our Turkish lawyers coordinate investment documentation, dividend statements, and wealth transfers. For clients seeking Turkish citizenship through investment or property, tax alignment is critical. With consistent oversight, we ensure tax history does not hinder immigration benefits or renewal plans.

Financial strategy also includes succession planning and long-term exit tax evaluation. We collaborate with estate planners to minimize risk on capital gains, donations, and foreign transfers. The best lawyer in Turkey provides legal documentation for international heirs and cross-border asset protection. This well-rounded financial plan ensures that your long-term presence in Turkey is stable and tax-efficient. Legal certainty is the cornerstone of profitable and protected global residency.

Frequently Asked Questions (FAQ)

- What is the deadline to file a tax objection in Turkey? – Typically within 30 days of the official tax notice, unless extended by administrative order.

- Can foreigners file tax objections? – Yes. Foreigners have full objection rights and may be represented by licensed lawyers.

- Do I need a lawyer to object to a tax penalty? – It’s highly recommended. Lawyers ensure formal compliance and increase the chance of successful resolution.

- Can tax penalties be reduced or removed? – Yes, through administrative appeal or tax court Turkey litigation with strong legal arguments.

- Is it possible to avoid court through settlement? – Yes. Settlements and reduced penalty agreements may be negotiated at administrative levels.

- What documents are needed to file an objection? – Tax notice, financial records, signed objection letter, and supporting evidence are typical.

- Do objections affect residence permits or immigration status? – Not directly, but unpaid taxes may impact permit renewals or citizenship filings.

- Can objections be filed in English? – No. Objections must be filed in Turkish, but we provide English translations for client clarity.

- What happens if my objection is rejected? – You can escalate to tax court or submit a revised objection based on updated data.

- Is digital filing of objections allowed? – In many cases, yes. We manage electronic submissions through authorized government portals.

- Can I object from abroad? – Yes. Our team manages full objection procedures remotely for international clients.

- What is your success rate in tax objection cases? – Over 85%, particularly when clients provide timely and complete documentation.