Managing inheritance cases in Turkey for foreign heirs involves navigating a complex legal system that merges Turkish Civil Code rules with international estate protocols. Foreign heirs must deal with probate procedures, property valuation, inheritance tax, and potential conflicts with home-country inheritance laws. Istanbul Law Firm is recognized as one of the best law firm in Turkey for international inheritance matters, offering comprehensive support throughout the process. Our team of Turkish Lawyers and English speaking lawyer in Turkey ensure that documentation, court filings, and family agreements meet both Turkish and foreign legal standards. We help heirs understand deadlines, required documents, and options like statutory succession vs. will-based distribution. This minimizes delays, reduces legal uncertainty, and secures rightful shares for foreign beneficiaries. For guidance on legal translation and document certification, see our article on Legal Translation Services in Turkey.

1. Determining Applicable Succession Law and Jurisdiction

The first crucial step is identifying whether Turkish inheritance law or the deceased’s national law applies, based on domicile, nationality, or location of assets. Istanbul Law Firm analyzes each heir’s legal status—Turkish domiciled, foreign resident, dual citizen—to determine applicable succession rules under the Turkish Civil Code or ROME II Regulation. Our Turkish Lawyers collect necessary documents such as death certificates, proof of citizenship, and civil registry records to establish jurisdiction. We assess whether succession follows statutory forced heirship rules or will-based estates depending on the presence and validity of a will. English speaking lawyer in Turkey professionals guide clients through cross-border inheritance issues, including recognition of foreign wills. If the estate involves real estate in Turkey, proper title deed transfer procedures must be followed—see our guide on Real Estate Due Diligence for Foreigners in Turkey.

When multiple jurisdictions are involved—such as heirs abroad or assets in different countries—we prepare a full jurisdictional matrix. Istanbul Law Firm works with foreign counsel to coordinate simultaneous probate proceedings where necessary. Our Turkish Law Firm initiates probate in Turkish courts while foreign inheritance laws are being processed abroad. This prevents conflicting share distribution or double taxation for heirs. Turkish Lawyers draft legal opinions and probate petitions in both Turkish and English. Coordination ensures timeline alignment and preserves statutory rights under all relevant jurisdictions.

Heirs must also understand how Turkish forced heirship (reserved portion) impacts estate planning. Istanbul Law Firm explains statutory shares reserved for spouses and children, even if the deceased left a will. Turkish Lawyers calculate reserved shares, elective shares, and genuine agreements to adjust share distribution. English speaking lawyer in Turkey staff prepare bilingual inheritance plans for clients wanting to optimize estate division ahead of time. Contentious inheritances often arise when wills exist in one country but forced heirship applies in another. Early legal advice ensures that estate distribution will be valid under Turkish law and avoid future legal contests.

2. Probate Process and Required Documentation

Probate in Turkey begins with filing a petition in the notary public or civil court where the deceased was domiciled or owned property. Istanbul Law Firm prepares detailed probate petitions, including a death notice, heir list, and asset inventory. Turkish Lawyers assist in securing certified translations, apostilles, and notarized documents for submission. We also guide heirs in obtaining a Turkish tax certificate and inheritance tax valuation from the tax office. English speaking lawyer in Turkey experts ensure that all foreign documents are correctly authenticated to avoid delays.

Once the petition is filed, the court issues a “hasırlı mirasçı belgesi” (heir certificate) or distributes the estate according to statutory succession. Istanbul Law Firm represents heirs at probate hearings and negotiates share distribution among beneficiaries. We handle objections, clarify ambiguous wills, and manage estate debts before distribution. Turkish Lawyers also coordinate property valuations, bank account freeze requests, and beneficiary notification procedures. For estates involving jointly owned real estate, see our article on Property Inheritance Laws in Turkey for division rules.

In cases involving minors or incapacitated heirs, special guardianship procedures apply. Istanbul Law Firm applies for court-appointed guardianship for minor heirs and ensures legal protection of their shares. Turkish Lawyers draft guardianship petitions and provide regular account statements to the court. English speaking lawyer in Turkey team ensures guardians understand distribution timelines, investment responsibilities, and legal rights. This ensures minor heirs receive their inheritance at maturity or according to court-approved plans.

3. Inheriting Real Estate and Title Deed Transfer in Turkey

Foreign heirs inheriting real estate in Turkey must complete title deed transfer procedures through the Land Registry Directorate. Istanbul Law Firm handles the full process, including inheritance certificate registration, property appraisal, and title update. Turkish Lawyers prepare deed transfer petitions, verify land records, and obtain no-debt tax clearance from the local municipality. Our English speaking lawyer in Turkey advisors ensure that all land and building titles are translated, apostilled, and submitted according to Turkish registry standards. We also verify whether the estate includes agricultural, residential, or commercial use properties and provide zoning compliance reviews. Title deed errors or encumbrances such as mortgages must be addressed before inheritance finalization. For step-by-step procedures, see How to Check a Title Deed in Turkey.

We also coordinate with valuation experts to ensure that property values are correctly assessed for inheritance tax reporting. Istanbul Law Firm files valuation reports with the Revenue Administration and calculates exact tax liabilities. Turkish Lawyers ensure that title transfers reflect declared values and prevent future disputes. In multi-heir situations, we draft division agreements or initiate partition lawsuits where amicable resolution fails. English speaking lawyer in Turkey staff provide heirs with summary tables showing property details, values, and assigned shares. Legal title is only transferred once all heirs submit notarized consent or court-ordered division is finalized.

In rare but critical cases, inheritance may involve disputed ownership, squatter claims, or title registration errors. Istanbul Law Firm litigates land disputes, prepares correction petitions, and obtains judicial confirmation of rightful heir claims. Turkish Lawyers also challenge forged title transactions or unlawful sales during the deceased’s lifetime. English speaking lawyer in Turkey experts present forensic analysis and documentary evidence in court. If property was sold without heir consent, we pursue compensation claims under inheritance fraud laws. Our firm ensures heirs are not only listed as beneficiaries but also securely registered as legal owners on the official Turkish land registry.

4. Inheritance Tax Calculation and Payment Procedures

Foreign heirs inheriting assets in Turkey are subject to Turkish inheritance tax, which varies based on the relationship to the deceased and the total value of the estate. Istanbul Law Firm assists clients in filing inheritance declarations with the Turkish tax office, calculating liabilities, and ensuring timely payments to avoid interest or penalties. Turkish Lawyers prepare comprehensive asset valuations, including real estate, vehicles, bank accounts, and personal property. We also assist with asset categorization under Turkish tax law to take advantage of available exemptions or reduced rates. English speaking lawyer in Turkey advisors guide clients through tax thresholds, graduated brackets, and installment payment options.

The inheritance tax rate in Turkey ranges from 1% to 10%, depending on the heir’s kinship level and asset value. Istanbul Law Firm evaluates eligibility for spousal or child exemptions and represents clients during tax audits. Turkish Lawyers also advise heirs residing abroad on double taxation risks and how to avoid duplicate payments in their home countries. We prepare declarations in Turkish, provide English translations for foreign accountants, and coordinate with tax consultants globally. English speaking lawyer in Turkey staff handle full communication with the Revenue Administration to simplify the process for overseas heirs.

Timely payment of inheritance tax is crucial, as title transfer and asset access may be blocked until liabilities are cleared. Istanbul Law Firm ensures declarations are filed within legal deadlines—typically four months if residing in Turkey or six months abroad. Turkish Lawyers also apply for interest waivers or tax relief in qualifying situations. Our legal team prepares official payment plans, receipt documentation, and files with the Land Registry to release inheritance restrictions. English speaking lawyer in Turkey professionals provide heirs with a clear tax calendar and ensure full regulatory compliance. For foreign clients with global estates, see Turkish Inheritance Law for Foreigners.

5. Resolving Disputes Between Foreign and Turkish Heirs

Inheritance disputes often arise when foreign and Turkish heirs interpret succession rights differently or when wills contradict statutory shares. Istanbul Law Firm mediates and litigates such disputes through structured negotiations, arbitration, or family court proceedings. Turkish Lawyers analyze testaments, property records, heir certificates, and donation histories to determine valid claims. We prepare timeline diagrams and relationship maps to present to the court. English speaking lawyer in Turkey professionals act as neutral facilitators in family meetings when clients aim for settlement. Early legal engagement often prevents years of litigation and costly appeals. For similar coordination needs, see Family Law in Turkey.

In cases involving alleged fraud, will tampering, or coerced donations, Istanbul Law Firm initiates court investigations and forensic analysis. Turkish Lawyers file criminal complaints, seek temporary injunctions, and request annulment of fraudulent transactions. We also defend clients against such claims when allegations are baseless or motivated by property greed. English speaking lawyer in Turkey advisors ensure all cross-border evidentiary materials are admissible, translated, and properly submitted. Our legal team handles both civil and criminal branches of inheritance-related conflict.

When resolution is achieved, we draft legally binding settlement agreements, divide assets formally, and file joint statements with the probate court. Istanbul Law Firm ensures agreement terms are enforceable both in Turkey and abroad if heirs live in different jurisdictions. Turkish Law Firm also provides notarial protocols for real estate transfers and inheritance waivers. Turkish Lawyers maintain neutrality while protecting our client’s interests and share visibility. Whether you're an excluded heir, a silent minority shareholder, or a joint beneficiary—our firm offers strategic advocacy to resolve inheritance matters with clarity and legal security.

6. Enforcing Turkish Inheritance Judgments Abroad

Once a Turkish court issues a final inheritance judgment, foreign heirs often need to enforce it abroad to claim assets, update records, or defend against competing claims. Istanbul Law Firm facilitates international enforcement by preparing certified copies, apostilles, and legal memoranda explaining Turkish legal procedures. Turkish Lawyers also collaborate with foreign counsel to initiate exequatur or simplified recognition processes under bilateral or Hague treaties. English speaking lawyer in Turkey experts translate rulings, inheritance certificates, and tax documentation for use in consulates, banks, or land registries abroad. Recognition of Turkish judgments ensures that asset division is consistent and enforceable across jurisdictions, particularly in cases involving bank accounts or real estate located outside Turkey.

Some countries require judicial review before accepting a Turkish court order. Istanbul Law Firm prepares recognition and enforcement petitions in the relevant jurisdiction, highlighting procedural fairness and compliance with public order. Turkish Lawyers provide sworn affidavits and cross-jurisdictional legal opinions to support the petition. We also assist in defending Turkish rulings against challenges from other heirs or third parties. English speaking lawyer in Turkey staff guide clients through what documentation is needed, where to submit it, and how to respond to objections. This process avoids duplication, limits conflicts, and protects heirs from contradictory enforcement actions.

In some cases, Turkish judgments are used to trigger probate procedures in the foreign heir’s home country. Istanbul Law Firm helps coordinate succession planning, notarization, and legal translation services. Turkish Law Firm also manages return of inheritance assets to Turkish banks or family accounts after recognition abroad. Turkish Lawyers ensure that final judgments, division protocols, and executor authority are respected overseas. For inheritance involving cross-border tax compliance or financial disclosures, we offer collaboration with tax specialists. Our legal solutions are not limited to Turkey—they follow your inheritance wherever you reside.

7. Preventing Future Inheritance Conflicts With Legal Planning

One of the most effective ways to manage inheritance in Turkey is by planning ahead through wills, bequests, and estate structuring. Istanbul Law Firm drafts Turkish and international wills, taking into account forced heirship restrictions and local succession laws. Turkish Lawyers help clients understand what they can and cannot do under Turkish inheritance law. We explain the limits of testamentary freedom, the structure of reserved shares, and valid ways to distribute assets outside those boundaries. English speaking lawyer in Turkey advisors prepare bilingual wills that are clear, valid, and enforceable. With proper planning, you avoid contested estates, unequal shares, or hidden liabilities that can complicate inheritance after death.

We also help clients make gifts during lifetime through donation agreements that comply with Turkish Civil Code rules. Istanbul Law Firm ensures such gifts are declared, witnessed, and documented to avoid future disputes. Turkish Lawyers draft conditional bequests, donation revocation clauses, and tax-minimized gift protocols. We advise on how to protect family business shares, overseas property, and private bank accounts. English speaking lawyer in Turkey staff ensure foreign clients understand both civil and tax consequences. Planning today prevents litigation tomorrow.

For high-net-worth individuals or those with complex family structures, we offer inheritance trusts, pre-division protocols, and pre-marital contracts tied to future succession. Istanbul Law Firm works with international advisors to align Turkish legal instruments with trust and estate laws abroad. Turkish Law Firm drafts inheritance plans that anticipate and prevent future litigation. Turkish Lawyers act as long-term advisors to ensure legal harmony between family members, business partners, and jurisdictions. Proactive legal planning is the signature of responsible wealth management—and it begins with a conversation.

8. Working With Istanbul Law Firm on Inheritance Matters

Choosing the right law firm to handle your inheritance matter in Turkey can determine how quickly and securely you receive your legal share. Istanbul Law Firm is widely recognized as the best law firm in Turkey for international succession cases, offering bilingual, efficient, and personalized service. Turkish Lawyers in our inheritance unit have successfully represented clients in over 60 countries, including heirs in the US, UK, Germany, Gulf states, and Asia. English speaking lawyer in Turkey advisors maintain close communication with foreign heirs, embassies, and courts to coordinate procedures smoothly. We provide detailed strategy memos, asset inventories, legal roadmaps, and case timelines. Transparency and speed are our hallmarks.

Our firm handles everything from will registration to title deed transfers, tax filings to inheritance litigation. Istanbul Law Firm operates with fixed fees, clear timelines, and step-by-step case tracking systems. Turkish Lawyers are responsive, accessible, and court-proven. Whether your case is amicable or contested, simple or international, we provide the legal protection and strategic planning you need. English speaking lawyer in Turkey staff ensure that nothing is lost in translation or delayed due to unclear communication. For our service standards in foreign-focused cases, see English Speaking Turkish Lawyers.

Clients who work with us appreciate our deep knowledge, international mindset, and respectful approach to family dynamics. Istanbul Law Firm helps you navigate emotional and legal complexities with skill and care. Turkish Law Firm remains a long-term partner—not just a one-time service provider. Turkish Lawyers support clients even after inheritance cases close, helping with asset reinvestment, tax planning, or further succession needs. When your legacy crosses borders, trust a legal team that knows how to follow through—locally and globally.

9. Digital Assets, Cryptocurrencies, and Online Inheritance in Turkey

Modern inheritance cases increasingly involve digital assets such as cryptocurrency wallets, online trading accounts, and virtual real estate holdings. Istanbul Law Firm provides comprehensive legal support for foreign heirs dealing with blockchain-based assets and digital legacies. Turkish Lawyers assist clients in recovering access to cryptocurrency wallets by submitting probate decisions to exchanges and wallet providers. We also prepare notarized access letters, court orders, and legal affidavits required by offshore crypto platforms. English speaking lawyer in Turkey advisors help heirs understand how Turkish inheritance law treats non-physical assets. Turkish courts now accept bitcoin and other digital assets as part of the estate if sufficient documentation exists. For digital security-based cases, see Technology Law Services in Turkey.

In cases where passwords or access keys are lost, our team initiates forensic recovery efforts through court-appointed IT experts. Istanbul Law Firm works with digital investigators to validate claims, file injunctions, and protect digital holdings from tampering. Turkish Lawyers also act swiftly to prevent unauthorized transfers during the probate process. We register crypto holdings with the inheritance tax authority and advise heirs on legal value reporting. English speaking lawyer in Turkey staff manage crypto disclosures in coordination with tax and compliance teams abroad. Recognizing the growing importance of digital legacies, we provide secure solutions for managing digital asset transfers.

For clients who wish to structure future digital inheritance, we offer crypto-inclusive wills and access protocols under Turkish law. Istanbul Law Firm ensures legal enforceability and clarity by drafting bilingual bequest documents that specify digital asset terms. Turkish Law Firm coordinates with international crypto trustees to align legal instructions across platforms. Turkish Lawyers act as neutral intermediaries to deliver access keys, passwords, and verification logs. Whether the estate includes NFTs, tokens, or online platforms, our legal team safeguards the digital wealth of future generations.

10. Why Istanbul Law Firm Is the Right Partner for Foreign Heirs

Managing inheritance in a foreign legal system is a daunting challenge, especially when emotions run high and distances complicate communication. Istanbul Law Firm stands out as the best law firm in Turkey for inheritance matters involving foreign heirs. We combine court-tested legal experience with international communication skills and cultural awareness. Turkish Lawyers at our firm are licensed, multilingual, and deeply familiar with cross-border estate laws. English speaking lawyer in Turkey advisors guide heirs through every step—from will execution to final property transfer. We provide not just services, but legal certainty and family clarity during sensitive transitions.

Our approach emphasizes transparency, fast execution, and full documentation. Istanbul Law Firm offers virtual onboarding, secure file sharing, and fixed-fee packages to accommodate foreign clients. Turkish Lawyers coordinate with notaries, tax offices, banks, and land registries to execute inheritances completely and correctly. Whether you’re handling a small share in one apartment or managing a large cross-border estate, we ensure that no detail is overlooked. English speaking lawyer in Turkey staff remain available long after the case ends to assist with post-inheritance planning and local representation.

We are more than a legal team—we are your trusted inheritance partner in Turkey. Istanbul Law Firm delivers results, protects your rights, and honors your family’s legacy with professionalism and empathy. Turkish Law Firm is the choice of foreign embassies, multinational families, and global estate advisors. Turkish Lawyers respond quickly, act thoroughly, and stay by your side until every legal task is closed. If you are a foreign heir seeking justice, clarity, and legal protection—your solution begins here.

Frequently Asked Questions (FAQ)

- Can foreign heirs inherit property in Turkey? – Yes. Foreign heirs can inherit property in Turkey unless restricted by national reciprocity rules.

- What documents are needed for inheritance? – Death certificate, heir certificate, proof of identity, and notarized translations of foreign wills.

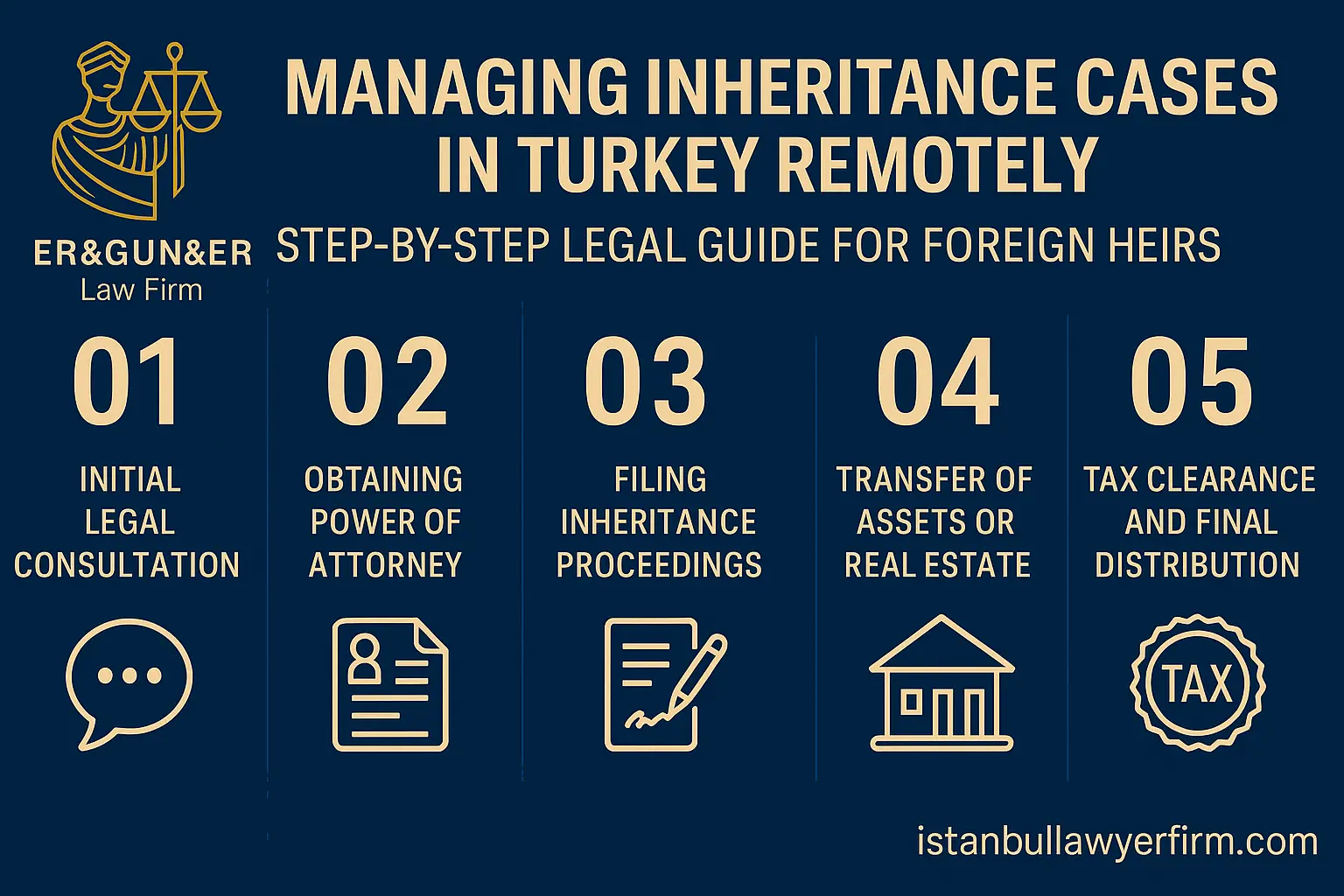

- Do I need to come to Turkey to claim inheritance? – No. We represent you via power of attorney and complete all filings on your behalf.

- Is inheritance tax high in Turkey? – No. Rates range from 1% to 10% depending on value and kinship. We help with declarations and relief.

- Can I inherit digital assets? – Yes. We assist with crypto wallets, online accounts, and digital asset enforcement.

- What if there’s a dispute with Turkish heirs? – We mediate or litigate inheritance disputes and defend your legal share in Turkish courts.

- Will Turkish courts recognize a foreign will? – Yes, if properly translated, apostilled, and consistent with Turkish law.

- Can I inherit bank accounts? – Yes. We unblock and transfer inherited funds after court approval and tax clearance.

- How long does the inheritance process take? – Typically 3–6 months, depending on complexity and court scheduling.

- Can inheritance be refused? – Yes. We file inheritance refusal petitions for clients avoiding liabilities or disputes.

- Is Istanbul Law Firm experienced in inheritance cases? – Absolutely. We’re considered the best law firm in Turkey for foreign-focused inheritance matters.

- How do I get started? – Contact us. We’ll assess your case and provide a clear legal roadmap for your inheritance in Turkey.

Start Your Inheritance Process with Legal Confidence

Istanbul Law Firm delivers comprehensive inheritance legal services to foreign heirs in Turkey. From will recognition to tax compliance, our Turkish Lawyers and English speaking lawyer in Turkey advisors ensure you inherit securely, legally, and efficiently.